nj bait tax example

Regardless of its participation in the BAIT a firm organized as a PTE must continue to withhold tax on the non-resident owners New Jersey income. 1418750 plus 652 percent for distributive proceeds between 250000 and 1000000.

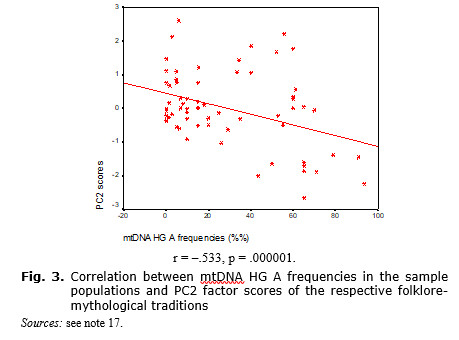

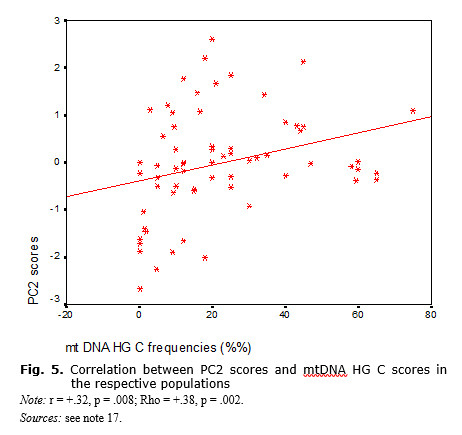

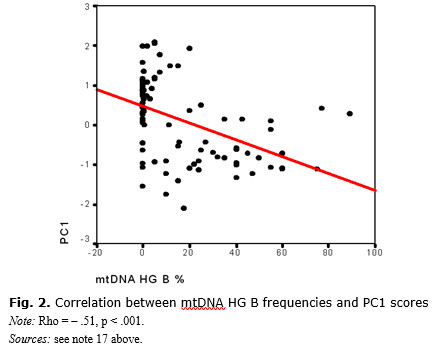

Genes And Myths Which Genes And Myths Did The Different Waves Of The Peopling Of Americas Bring To The New World

On January 13 2020 Governor Phil Murphy signed into law Senate Bill 3246 S.

. Mechanics of the BAIT Election. Pass-Through Business Alternative Income Tax Act. The entity could elect to take the BAIT pay 63087 of New Jersey taxes for its members and receive a tax deduction for that thus.

Finally we add the 63087 base to the 10900 tax to obtain the elective entity tax. The distributive proceeds sourced to New Jersey are allocated 750000 to Member A and 750000 to Member B. Wisconsin did not enact a brand-new tax.

The New Jersey Division of Taxation has provided answers to several recent questions about the New Jersey Business Alternative Income Tax BAIT. By explicitly stating New Jersey will allow credits for similar tax regimes eg Connecticut the Division appears to be inviting other states to. From this calculation we can see that our elective entity tax is 73987 for the collective 3 members.

The 2021 PTE-200-T Extension of Time to File grants a six-month extension to September 15 2022. In New Jersey the PTE tax rates are progressive and based on the sum of each members share of distributive. 5675 percent for distributive proceeds under 250000.

Rather in that state an electing PTE can instead elect to be treated as a C corporation solely for Wisconsin income tax purposes and thus be subject to a flat 79 entity-level tax 13 14. The 2021 PTE-200-T Extension of Time to File grants a six-month extension to September 15 2022. 3246 or bill establishing the business alternative income tax BAIT an elective New Jersey business tax regime for pass-through entities PTEs.

This new law allows pass-through businesses to pay income taxes at the entity level instead of the personal level. S corporation S has net income of 1000000 in 2020 and one individual shareholder A. Assume ABC LLC has 1000000 of taxable income.

Assume a PTE filed its 2021 BAIT return on March 1 2022. Partners with a calendar year end of 123122 will claim credit for their share of the 2021 BAIT on their 2022 New Jersey tax returns. For New Jersey purposes income and losses of a pass-through entity are passed through to its.

PL2019 c320 enacted the Pass-Through Business Alternative Income Tax Act effective for tax years beginning on or after January 1 2020. Congress imposed the SALT cap on individuals as part of the tax reform law in 2017. Returns due between March 15 2022 and June 15 2022 are due by June 15 2022This includes the 2021 PTE Election 2021 PTE-100 Tax Returns 2021 PTE-200-T 2021 Revocation forms and 2022 Estimated Payments.

To elect the BAIT each member of a PTE must consent to an annual election due on or before the original due date without. 1418750 plus 652 for distributive proceeds between 250000 and 1000000. An increasing number of states are embracing an entity-level income tax on pass-through entities PTEs as a way to mitigate the 10000 deduction limit for state and local income taxes SALT cap.

For the 2020 tax year the four tiers of income tax rates are as follows. The New Jersey Business Alternative Income Tax also referred to as BAIT or NJ BAIT helps business owners mitigate the negative impact of the federal state. The BAIT is an elective tax regime effective for tax years beginning on or after January 1 2020 whereby qualifying pass-through business entities may elect to pay tax at the entity level.

By passing through a net amount of income reduced by the SALT deduction the owner is able to fully deduct their New Jersey taxes for federal purposes. This date is not extended. 6308750 plus 912 percent for distributive proceeds between 1000000 and 5000000.

Therefore the BAIT may result in a significant overpayment 1 of non-resident tax until the owners can file their individual tax returns to claim refunds which could be as late as October of the following year. Consider the following simplified example. The BAIT program is intended to give New Jersey individual income taxpayers a work-around of the 10000 annual limitation on the.

The tax rates for NJ BAIT range from 5675 to as high as 109 on New Jersey sourced income. Pass-through entity AB has 2 New Jersey resident members with total income of 1500000 that is 100 sourced to New Jersey. 63087 10900 1100000 1000000 100000 x 109 10900 73987.

BAIT filers should be aware that the NJ Division of Taxation made certain key changes that affect 2021 BAIT reporting. For New Jersey tax purposes income and losses of a pass-through entity are passed through to its members. 42788750 plus 109 for distributive proceeds over 5000000.

The New Jersey pass-through entity tax took effect Jan. Since New Jerseys enactment of the Pass-Through Business Alternative Income Tax BAIT professional service firms and other pass-through entities have begun to reap the federal income tax benefits of this entity-level tax. For tax years beginning on or after January 1 2020 the four tiers of income tax rates are as follows.

However pass-through entities may elect to pay a Pass-Through Business Alternative Income Tax due on the sum of. Tax is imposed on the sum of each members share of distributive proceeds which is 1500000. Were going to take a deduction for the New Jersey BAIT paid in 1581750 resulting in 25918250 a federal income and allocated the three ways 8639417.

Pass-Through Business Alternative Income Tax Act. ASC 740 Considerations for Pass-Through Entity Tax Regimes.

Overview Of Sia Method 1 Initial Gappy Alignment The Example Shows Download Scientific Diagram

New York State S New Pass Through Entity Tax The Cpa Journal

South Carolina Sales Tax Small Business Guide Truic

Phishing Attacks Survey Types Vectors And Technical Approaches Document Gale Academic Onefile

Dental Insurance 101 In 2022 Dental Insurance Plans Dental Insurance Dental Coverage

Genes And Myths Which Genes And Myths Did The Different Waves Of The Peopling Of Americas Bring To The New World

Opendoor Reviews Ratings How It Works And Faqs

Why It S Super Important To Lock Your Mortgage Rate

Genes And Myths Which Genes And Myths Did The Different Waves Of The Peopling Of Americas Bring To The New World

Combinatorial Peptide Libraries Mining For Cell Binding Peptides Chemical Reviews

Overview Of Sia Method 1 Initial Gappy Alignment The Example Shows Download Scientific Diagram

Federal Register Real Estate Settlement Procedures Act Respa Proposed Rule To Simplify And Improve The Process Of Obtaining Mortgages And Reduce Consumer Settlement Costs